Nurturing Financial Legacies: A Blueprint for Black Parents to Secure Prosperity and Success for their Children

By Faisale Shefawe

02/05/24

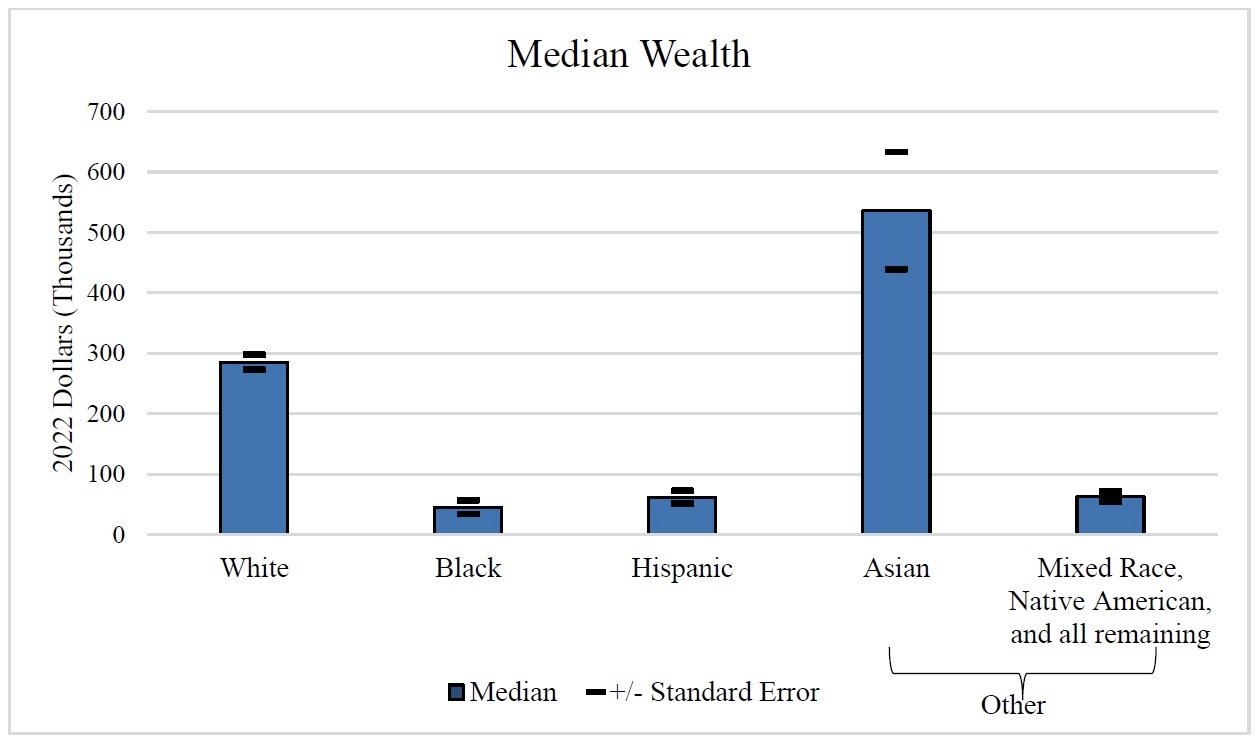

According to The Federal Reserve Survey of Consumer Finance (SCF), the wealth gap between White and Black families persists, with the typical White family having approximately six times as much wealth as the typical Black family. The survey reveals that the typical Black family possesses only $16 in wealth for every $100 held by their White counterparts. While there has been some improvement since 2013, when the gap was even wider, with a typical Black family having only $9 in wealth for every $100 held by their White peers, much work remains to address and reduce income inequality among racial groups.

The responsibility to create a wealthier Black generation falls significantly on Black parents. To bridge the gap, Black parents must not only strive to prepare their children for a brighter financial future but also actively engage in initiatives that contribute to closing the wealth divide.

In the most recent National Center for Education Statistics, progress is evident, with 27.6% of the Black population aged 25 and older holding a bachelor's degree, up from 21.2% in the period from 2012 to 2022. Nevertheless, compared to other racial groups, there is still ground to cover, as 41.8% of the White population and 59.3% of the Asian population hold college degrees. Encouragingly, the increasing number of Black individuals obtaining college degrees is a positive trend that needs to continue.

One of the challenges hindering higher education attainment among the Black population is the lack of exposure to high-paying jobs that could serve as motivation. Unlike their White and Asian counterparts, Black children often lack insight into the opportunities associated with professional careers, resulting in a gravitation towards jobs that do not require college degrees. Black parents must not only advocate for college education but also actively expose their children to high-paying professions through mentorship programs and internships.

Furthermore, entrepreneurship presents another avenue for Black individuals to create wealth. While a college degree is valuable, it's not the sole path to financial success. The Pew Research Center reports that majority-owned Black businesses accounted for only 3% of all U.S firms in 2020, representing 1% of gross revenue. Encouraging Black children to become entrepreneurs or investors can be a powerful way to generate wealth independently of a traditional college education.

In addition to education and entrepreneurship, Black parents should consider wealth transfer strategies. Currently, the Black homeownership rate in the US stands at 45%, according to the Statistic. Increasing homeownership among Black parents can be a pivotal step toward building intergenerational wealth. Real estate ownership provides a stable asset whose value tends to appreciate over time, offering a platform for further investments or business ventures.

Rate of Home Ownership in the United States in 2022, by Race

Moreover, affordable options for wealth transfer, such as purchasing financial products like annuities or life insurance, can significantly benefit Black children. NBC news reports that 56% of Black Americans own life insurance, providing a solid foundation for creating a wealthier Black population. These financial products are accessible to a wide range of individuals, making them an effective means of securing the financial health of future generations.

Today's hard work will undoubtedly shape the future. Black parents play a crucial role in creating a better financial landscape for their children. By emphasizing clear paths to college education, fostering an entrepreneurial spirit, and strategically transferring assets through homeownership and financial products, Black parents can pave the way for a wealthier and more prosperous future for the generations to come.